As food distributors scale, fulfilment challenges rarely show up as one big failure.

They arrive quietly — missed items, incorrect substitutions, delayed dispatches, frustrated buyers, stressed operations teams.

One of the most common (and least discussed) root causes behind these issues is fragmented product catalogues.

Not demand.

Not staffing.

Not logistics partners.

Catalogues.

This article breaks down how fragmented catalogues slow fulfilment, why the problem compounds as you grow, and what operationally mature distributors do to fix it before it becomes a margin and reputation issue.

What Is a Fragmented Catalogue?

A catalogue becomes fragmented when product information is:

- Spread across multiple systems

- Maintained in manual spreadsheets

- Updated inconsistently between teams

- Recreated separately for sales, operations, and buyers

Common Signs of Catalogue Fragmentation

You may be dealing with catalogue fragmentation if:

- Sales and operations reference different product lists

- Buyers see items that are out of stock or unavailable

- SKUs are duplicated with slight naming differences

- Pricing changes don’t sync everywhere at once

- New products require manual updates in multiple places

Individually, these feel manageable.

Collectively, they slow fulfilment more than most teams realise.

How Fragmented Catalogues Directly Slow Fulfilment

1. Slower Order Processing

When catalogues are fragmented, every order requires human interpretation.

Operations teams must:

- Clarify ambiguous product names

- Cross-check SKUs

- Confirm substitutions

- Resolve pricing mismatches

What should be a straight-through process becomes a manual review loop.

Even small delays here ripple downstream into picking, packing, and dispatch.

2. Increased Picking & Packing Errors

Warehouse teams rely on clarity and consistency.

Fragmented catalogues introduce:

- Similar products with different labels

- Missing pack size information

- Unclear unit definitions (each vs carton vs weight)

This leads to:

- Wrong items picked

- Incorrect quantities

- More rework and returns

Errors don’t just cost money — they erode buyer confidence.

3. Bottlenecks During Peak Volume

Fragmentation doesn’t hurt much at low order volumes.

It becomes dangerous at scale.

As orders increase:

- Manual checks multiply

- Exceptions become the norm

- Senior staff get pulled into basic problem-solving

This caps growth long before warehouse capacity or demand does.

The Hidden Costs Most Teams Underestimate

Operational Load Increases Without Headcount Visibility

Fragmented catalogues quietly increase:

- Time per order

- Cognitive load on staff

- Dependency on “tribal knowledge”

Teams often respond by hiring — without realising the root issue is structural, not capacity-related.

Buyer Experience Suffers First

Buyers experience fragmentation as:

- Inconsistent availability

- Order corrections after checkout

- Delayed fulfilment

- Reduced trust in ordering accuracy

Many don’t complain.

They simply order less — or look elsewhere.

Why This Problem Gets Worse Over Time

Catalogue fragmentation compounds as you add:

- More suppliers

- More SKUs

- More buyer segments

- More pricing rules

- More compliance requirements

Each workaround added today becomes tomorrow’s constraint.

What started as “just a spreadsheet” becomes operational debt.

What High-Performing Distributors Do Differently

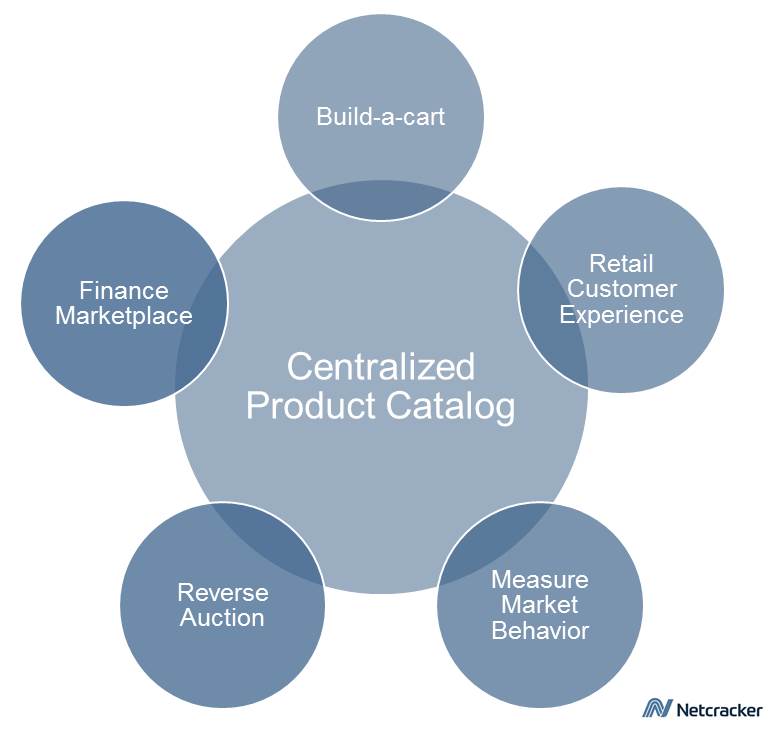

1. They Treat the Catalogue as Core Infrastructure

Leading distributors treat catalogues as:

- A single source of truth

- Shared infrastructure across teams

- A living system, not a static list

Product data isn’t owned by one team — it’s governed centrally.

2. They Standardise Before They Automate

Before adding automation, they:

- Clean SKUs

- Standardise naming conventions

- Define units clearly

- Align availability rules

Automation amplifies structure — or chaos.

3. They Connect Catalogues Directly to Fulfilment Logic

High-performing systems ensure:

- Only available products are orderable

- Pack sizes match picking workflows

- Substitutions are rule-based, not ad hoc

- Changes propagate instantly across ordering and operations

This reduces exceptions and speeds up fulfilment without adding staff.

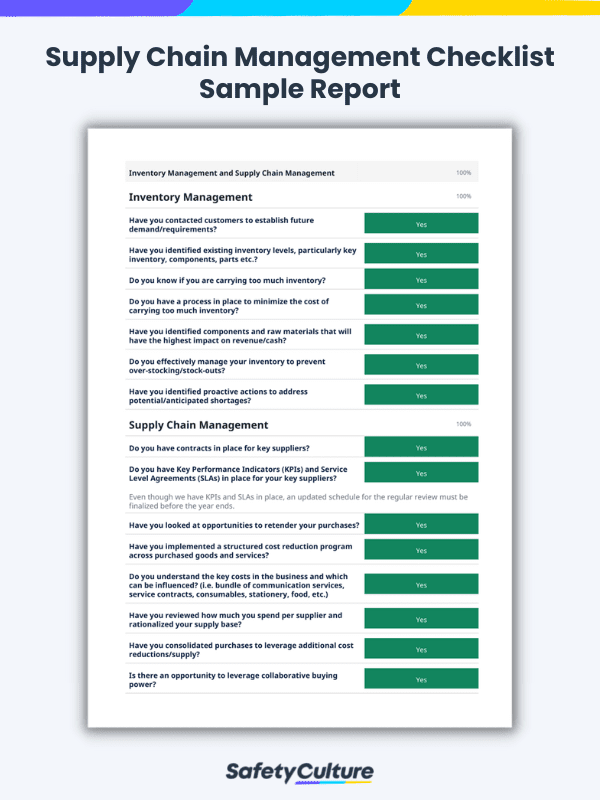

A Practical Starting Checklist

Use this internally to assess your current state:

Catalogue Health Check

- Do all teams reference the same product list?

- Are SKUs uniquely defined and enforced?

- Are pack sizes and units unambiguous?

- Does availability update in real time?

- Can fulfilment teams rely on orders without clarification?

If you hesitated on more than one — fragmentation is already costing you.

Fixing Fragmentation Without Disrupting Operations

You don’t need a full system overhaul overnight.

Most teams succeed by:

- Centralising catalogue ownership

- Cleaning and standardising core SKUs

- Aligning ordering logic with fulfilment realities

- Gradually retiring manual workarounds

The goal isn’t perfection — it’s operational clarity.

Want to See What This Looks Like in Practice?

Many distribution teams start by running a quick internal snapshot of where catalogue friction is creeping in — before it impacts fulfilment or buyer trust.

If helpful, you can:

- Review a short internal checklist teams use during ops reviews

- Or run a quick operational snapshot to identify hidden friction points

No sales pressure — just practical tools teams use as they grow.

Fragmented catalogues rarely feel urgent — until fulfilment slows, errors rise, and growth stalls.

The earlier you treat catalogue structure as operational infrastructure, the easier scaling becomes.